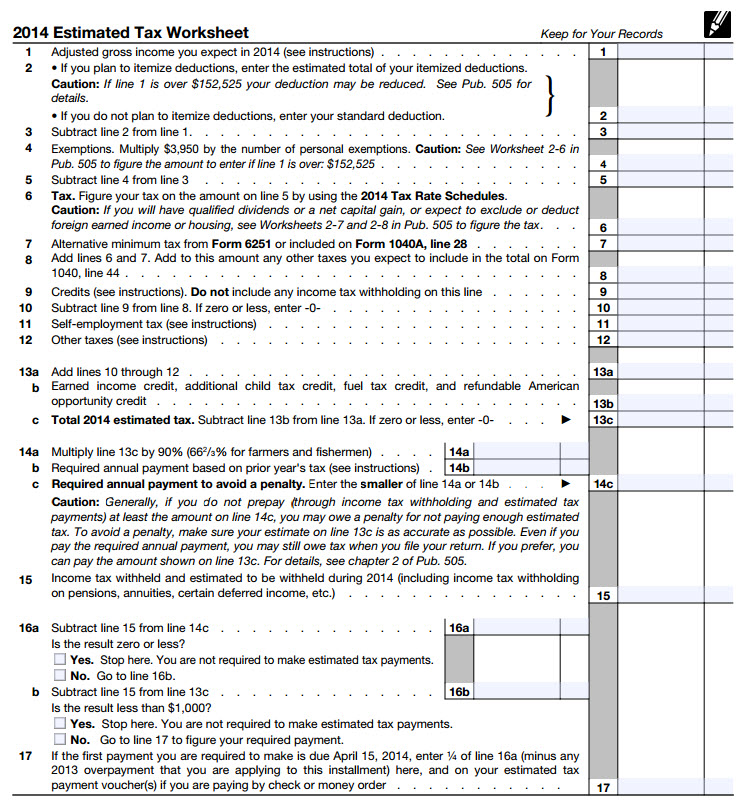

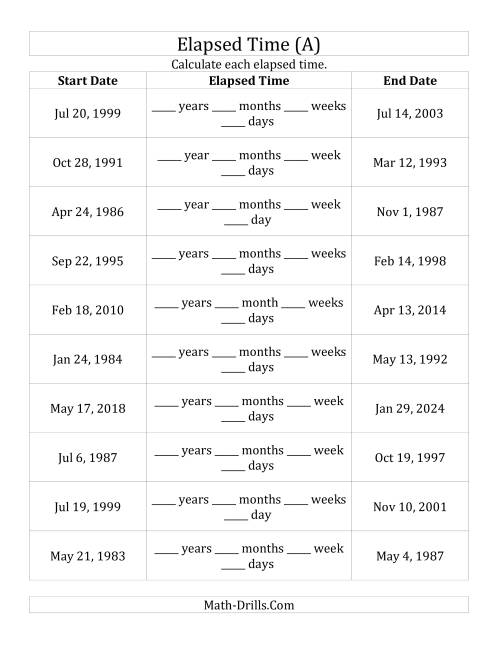

Estimated Tax Worksheet For Next Year. If your income changes during the year, you should complete the amended worksheet. Fiscal Year Taxpayers Fiscal year filers must estimate their tax for the period covered by their fiscal year, and change When any date falls on a Saturday, Sunday, or legal holid ay, substitute the next regular workday.

Having to calculate and pay estimated quarterly taxes four times a year may seem like a chore.

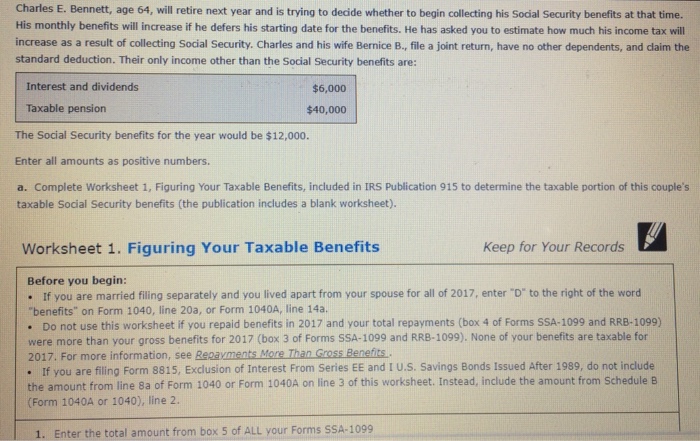

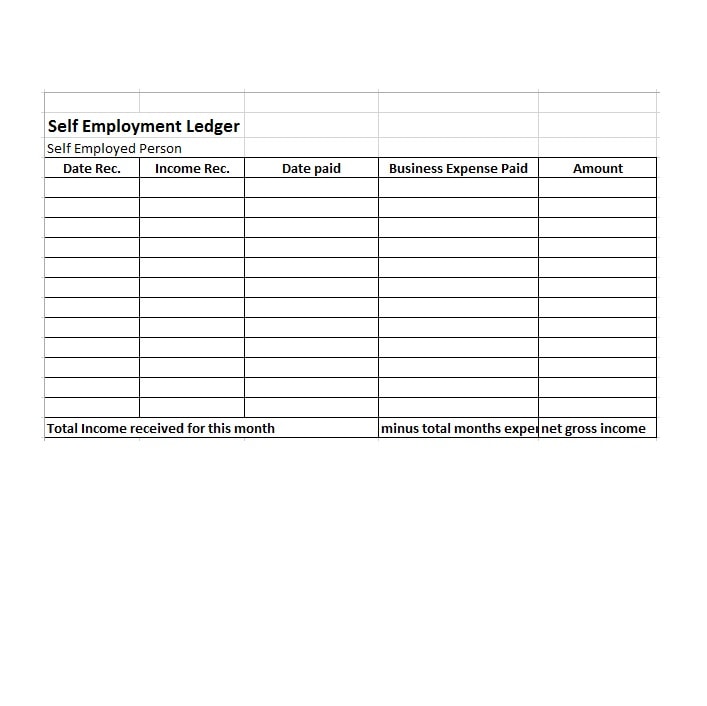

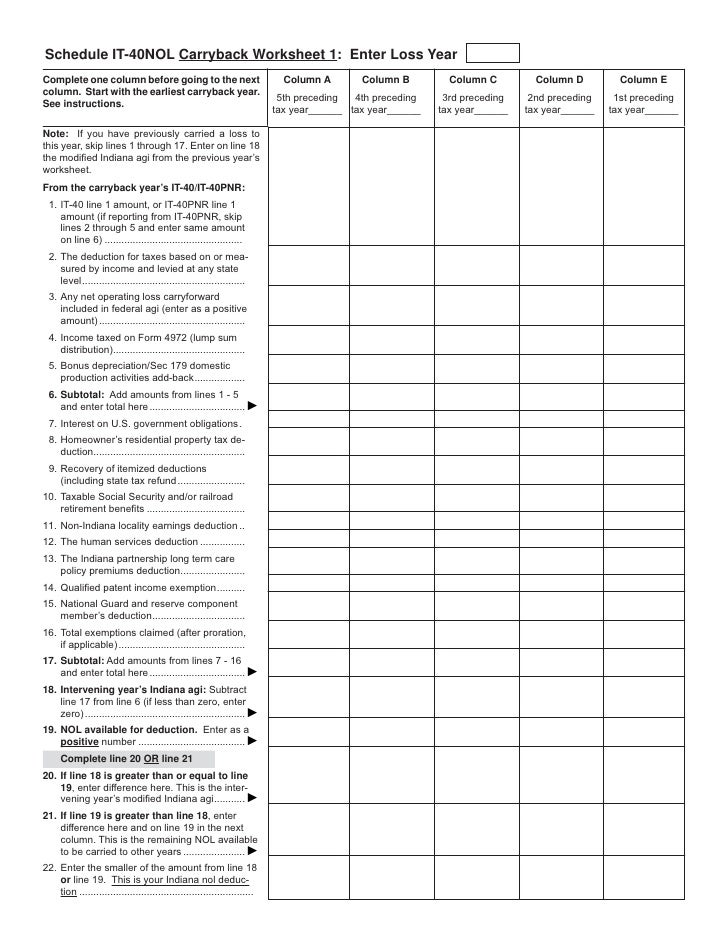

Build Excel worksheet for adjusting adjusting & tax entries, reconciling net income calculated on a book and tax basis.

Usually, you pay your estimated tax payments in four equal installments. Most salaried and hourly employees do not need to make estimated tax payments because taxes are automatically deducted Next, calculate how much you owe in self-employment tax. Professional tax software for CPAs, accountants, and tax professionals.