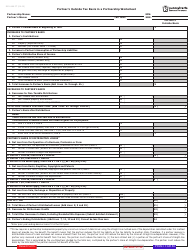

Comcast Tax Basis Worksheet. To determine your per share tax basis in your Comcast Corporation shares, divide the aggregate tax basis in the Comcast Corporation shares by the number of Comcast Corporation shares you received. Since all shares of the AT&T Broadband stock were converted to Comcast Corp, the tax basis of the new Comcast stock (via AT & T) should be allocated as.

If your circumstances are different, or if you have any questions, we encourage you to consult your tax adviser.

First, click on the link for "investor relations." On the next page, click on "tax basis information." Then, click on "tax basis worksheets." You will then be prompted, step by step, to fill out.

You will find this faster and easier than any AT&T "worksheet." Please read the Tax Basis Instructions before using this worksheet. Use your adjusted basis to determine your taxable gain/loss amounts. Earned Income Credit Worksheet Eic Worksheet.